By Jonathan Ntege Lubwama

- Nigeria’s e-Naira digital currency has seen a transaction volume of $9.3M 10 months

- 40% of the Nigerian population does not have a bank account

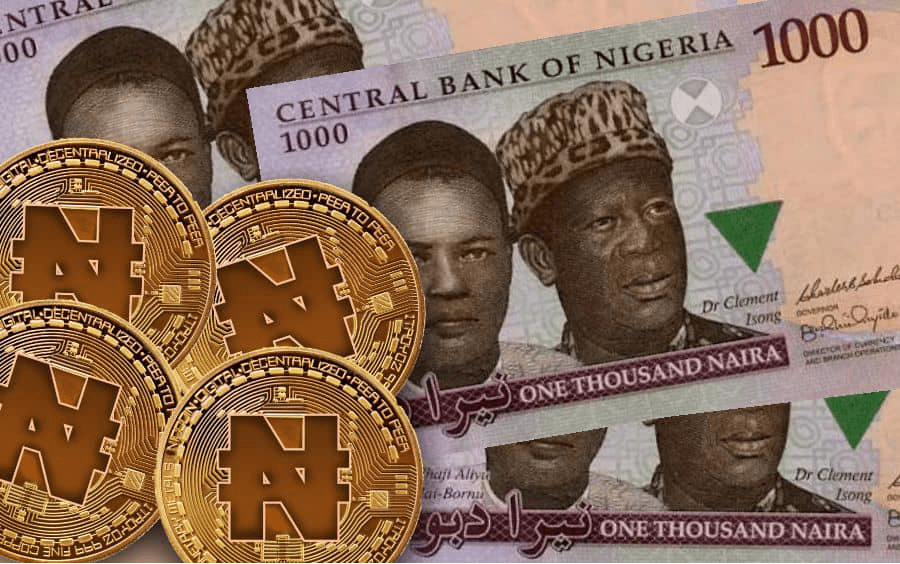

Nigeria’s Central Bank Digital Currency(CBDC), the e-Naira, is yet to have recurring users, almost a year since it was launched. With nearly $10 million worth of transactions, the Central Bank of Nigeria (CBN) believes it has scored some wins. The problem lies with the fact the country has a population of about 200 million people, and around 40% of the population doesn’t have a bank account.

Why This Matters: Last October, the CBN launched it e-Naira digital currency, becoming the second country in the world to launch a CBDC after the Bahamas. The e-Naira endured a tumultuous first week, in which its app was temporarily banned from the Google Play store. Since then, the app has been downloaded 840,000 times with 270,000 active users including 17,000 merchants. So far, the transaction volume has hit $9.3 million in 10 months.

Launching e-Naira was interpreted as a move by the CBN to quell cryptocurrency adoption in Nigeria. Despite banning banks from enabling crypto transactions in February 2021, 56% of Nigerian adults trade crypto at least once a month. However, the CBN’s official position on the e-Naira has always been bringing financial inclusion for its unbanked population which stands at 59 million adults.

What’s Next: Phase 1 of the e-Naira targeted Nigerians with bank accounts and smartphones. However, phase 2 will target the unbanked as the CBN looks to attract 8 million new users through signing up using a USSD code. Also, the government expects the e-Naira to add $29 billion in the next 10 years to Nigeria’s $430 billion GDP which makes it the largest economy in Africa.

CBx Vibe: “E No Easy” M.anifest Feat Tiggs da Author