By CultureBanx Team

- VegaX Holdings, an index driven crypto asset management platform is disrupting the sector

- The Global FinTech Blockchain market is expected to reach $23.9B by 2026

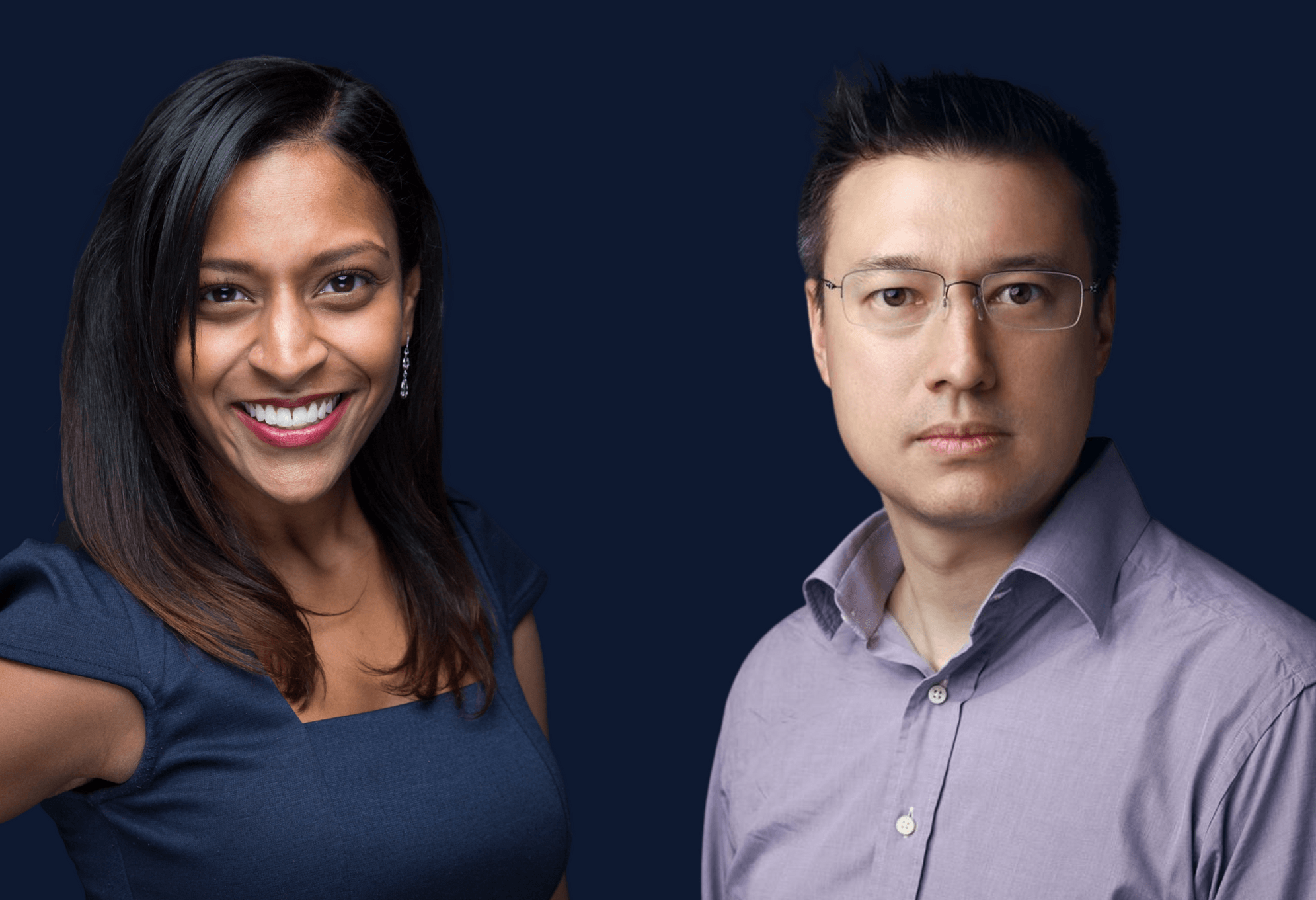

Increased demand for crypto assets could also create a more sustainable inclusive capital ecosystem. Natasha Bansgopaul, co-founder and COO of VegaX Holdings, an index driven crypto asset management platform, is successfully tapping into that as a venture-backed company. Her organization is disrupting the Global FinTech Blockchain market that’s expected to reach $23.9 billion by 2026. With crypto’s ability to tap into diverse audiences, along with under-represented founder’s at the helm of innovative companies in the sector, perhaps this is the key needed to shift the paradigm and ignite cultural capital.

Why This Matters: The majority of Black female founders have a very hard time raising $1 million+ and Bansogopaul is a serial entrepreneur and major player in the fin-tech space who has accomplished this feat multiple times over, as CultureBanx noted during its “Igniting Cultural Capital” session with UBS. VegaX Holdings has already raised a multi-million seed round from major institutional investors including SOSV, and are well on their way to closing their Series A round.

With Just under one in four, about 23%, of Black people owning this caché currency, compared to 11% of White Americans, and 17% of Hispanics, it’s imperative for the Black community to be included in this next wealth generating financial phase. In some ways cryptocurrencies offer a new decentralized financial model allowing Black communities to grow their own wealth, after being ostracized for so long from traditional banking institutions.

Bansgopaul stated crypto plays an important role as an alternative financial product when it comes to cultivating cultural capital. “It’s a unique opportunity for people to get in and lead with your own drive and motivation to learn and start carving out a space for yourself, she said”

Also, Bansogpaul commented on how cultural capital is typically at the core of most Black and brown led companies. “These founders tend to build with a lens of minority inclusion and talent building.

One of VegaX’s investors William Bao Bean, SOSV General Partner, is committed to investing in founders looking to solve problems and Bansogopaul’s VegaX fits the bill. SOSV’s $1.2 Billion fund is the third most active venture capital investors in the world.

Bao Bean wants more under-represented founders to have an opportunity to grow their businesses and believes inclusive capital is a major component to make that happen. “The goal is to be able to solve everyone’s problem, which is why we invest in 150 companies every year,” he said

Situational Awareness: Cryptocurrencies are an attractive financial option with about 2 in 5 Black adults likely to purchase or invest in Bitcoin, compared to roughly 3 in 10 adults overall, according to morning consult data. Platforms like Vegax Holdings can have a major impact on increasing cultural capital in the Black community, by bringing investors direct access to actionable crypto-indexes, that can improve their investment portfolios and become a new language of economic empowerment.

CBx Vibe: “Crypto” Yo Gotti