By CultureBanx Team

- Over 40% of Black Americans make less than $30K per year, putting them at an income disadvantage if taxes are not filed correctly

- Ordinary income, like wages, tend to be taxed between 10% to 37% depending on the amount

Let’s face it, preparing your taxes can be difficult if not an arduous process, and for several years now the IRS has advocated for a free filing system to make it easier for Americans to complete their taxes. However, with the adoption of new tax legislation in 2019, the filing process is destined to stay complex, becoming a win for the tax preparation industry, while keeping Black people in a sunken tax place. Over 40% of Black Americans make less than $30,000 per year, putting them at an income disadvantage if taxes are not filed correctly.

Why This Matters: Market Watch found the tax code amplifies the disproportionate racial wealth gap that already exists, based on the way our economy works and the way our society treats African Americans. Also, local taxes tend to be flatter, eating up more money from lower-earning households as a proportion of their income.

The tax code amplifies the disproportionate racial wealth gap that already exists

Here’s the kicker, most Black people aren’t able to capitalize on some of the most lucrative areas of filing taxes. For example, let’s look at capital gains taxes which kick in at the sale, compared to income that’s taxed as you make it. Ordinary income, like wages, tend to be taxed between 10% to 37% depending on the amount. On the other hand for capital gains, such as proceeds from selling stocks, are only taxed between 0% to 20%.

This makes capital gains taxes a good deal for people who invest in the stock market. Unfortunately, only 36% of African Americans participate in the stock market in some way, compared to 60% of white Americans.

If we look at the earned income tax-credit (EITC), which is touted by researchers as a powerful anti-poverty measure, to help low- income households. The U.S. census found that in 2018, the EITC, combined with the child tax credit, kept 8.9 million people out of poverty. This sounds like a good idea until one realizes that 20% of eligible families miss out on this opportunity, in part, due to the complication of claiming it through the filing process, and the IRS gives a closer look at returns claiming the EITC.

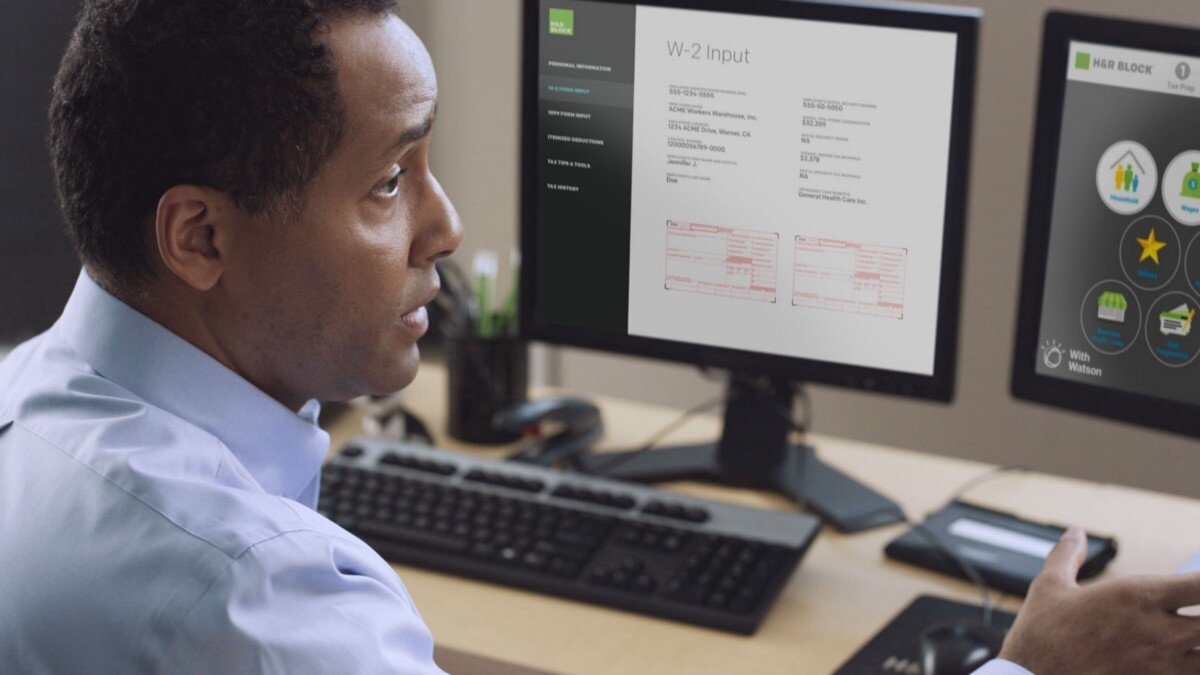

Situational Awareness: Even if more Black people were able to tap into the aforementioned tax saving opportunities, the 2019 Taxpayer First Act prohibits the IRS from creating a free online filing system. The tax industry giants have made sure this was the case because in 2018 alone, H&R Block (HRB +1.47%) and Intuit (INTU +0.59%), Turbo Taxes parent company, spent $6.6 million lobbying for tax legislation. The more complex the tax filing process becomes, the more revenue that can be generated, and these companies brought in $3.3 billion and $5.9 billion respectively in revenues during their fiscal 2018 year.

CBx Vibe: “Warning” The Notorious B.I.G.