By CultureBanx Team

- Kevin Durant’s Infinite Acquisition Corp filed for an IPO of up to $200M

- As of September 2021, SPACs have raised $122 billion in IPOs in the U.S.

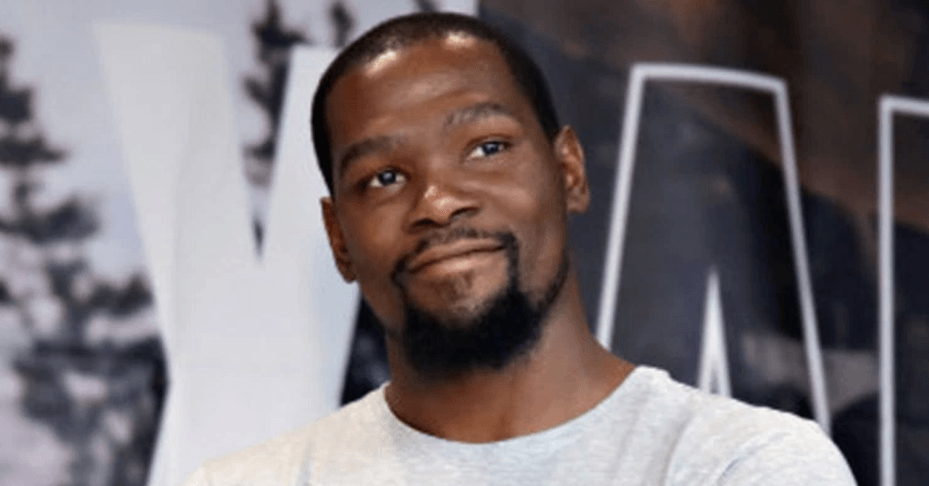

NBA star Kevin Durant has become the latest celebrity to endorse a blank-check firm after his Infinite Acquisition Corp filed for an initial public offering of up to $200 million. The basketball star’s SPAC will focus on buying companies in sectors such as sports, health, e-commerce, food and cryptocurrency.

Why This Matters: For reference, a SPAC is a company with no business operations, set up for the sole purpose of raising capital through an initial public offering with the goal of buying an existing organization. The industry has attracted the attention of other celebrities, including rapper Jay-Z, tennis star Serena Williams and NBA Hall of Famer Shaquille O’Neal. Durant will co-lead the SPAC alongside his manager, entrepreneur Rich Kleiman and investment and merchant bank LionTree is a sponsor.

SPAC mania had taken hold of the public markets in 2020, these types of IPOs raised almost twice as much money as they did in the previous 10 years combined, and had already surpassed 2019 levels by March 2021. As of September 2021, SPACs have raised $122 billion in IPOs in the U.S.

What’s Next: With the popularity of blank check companies comes increased scrutiny, because SPACs raise cash in an IPO and then have two years to search for a private company with which to merge and thereby bring public. Infinite Acquisition is offering 20 million units at $10 each, and said it would redeem 100% of the shares for cash if it does not close a merger within 18 months after the offering closes.

CBx Vibe: “Investment” Rich Homie Quan