By Claire Moraa

- Kanye West’s breakup from Adidas seems to be an expensive affair as the sportwear brand is recording unusual losses, high levels of inventory and excessive tax burden

- Adidas shares have dropped by 4% and registered its first annual net loss in over three decades

It’s no secret Adidas (ADDYY +2.79%%) has had a tumultuous ride when it comes to its partnership with Ye. Just when the tide was about to settle and the German sportswear brand had projected a $542.3M profit in 2024 after a $63M loss in 2023, things are taking a turn for the worse. Top markets are registering incredibly low sales with high levels of inventory.

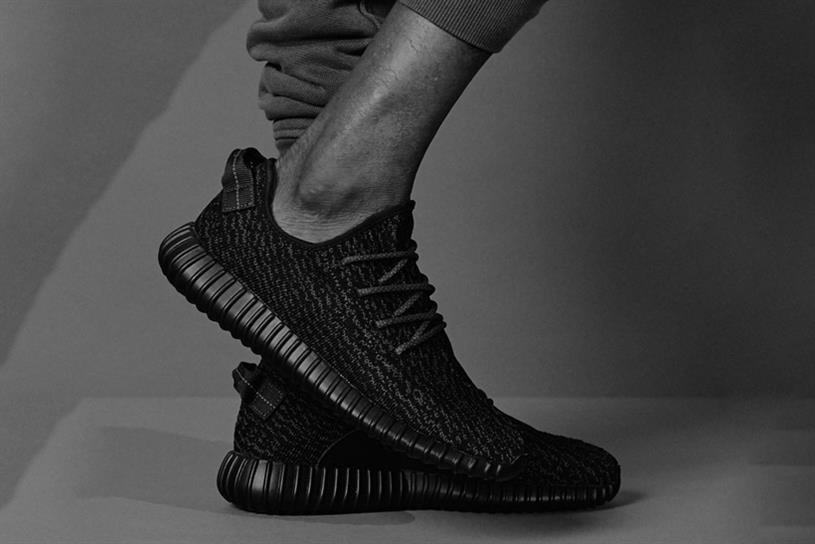

Why This Matters: The aftermath of the anti-semantic remarks made by Kanye left Adidas grappling with a vast Yeezy shoe inventory, raising concerns about how to manage this predicament. Its second largest market which is North America had a 16% decline in sales in the last year and with a $290-million-worth Yeezy inventory that needs to be written off, things weren’t looking up. It now seems sales particularly in North America will fall to 5% this year.

Adidas has been focusing on partnerships with other artists, such as Bad Bunny, Pharell Williams, and Beyoncé. However, these collaborations haven’t always met financial expectations. Sales for Ivy Park plummeted more than 50% to $40 million in 2022, falling considerably short of the projected $250 million.

By slashing sales to wholesalers, Adidas aimed to reduce the excess inventory levels in the market. High levels of inventory can lead to discounting and markdowns, which can erode brand value and profitability. However, Adidas’ decision to sell its remaining Yeezy stock and donate proceeds to organizations combatting discrimination and hate underscores the company’s commitment to using its platform and resources for positive social impact.

A Promising Outlook

The Yeezy dilemma, although catastrophic, Adidas has a positive outlook on the the future. The road to recovery isn’t looking too cloudy and if the sales in China are anything to go by, it could be a 360 degree turnaround. Sales are growing steadily and gearing towards double digits in 2024.

The tax rates are also starting to loosen up so with a reduced tax burden, Adidas can free up capital and flexibility in its financial planning. Things are also looking up for the inventory. Fewer items are now on the discount basket. Reduced reliance on discounted merchandise means the company can sell products at higher prices, leading to increased revenue and profitability.

What’s Next: While the Yeezy and Adidas partnership had its run, it comes as a lesson. Over reliance on specific product lines is not sustainable in the long run. Diversifying its product portfolio and investing in other high-demand categories such as athleisure, performance apparel, or sustainable fashion can help offset any sale declines and reduce vulnerability to market fluctuations.

CBX Vibe: “All Falls Down” Kanye West, Syleena Johnson