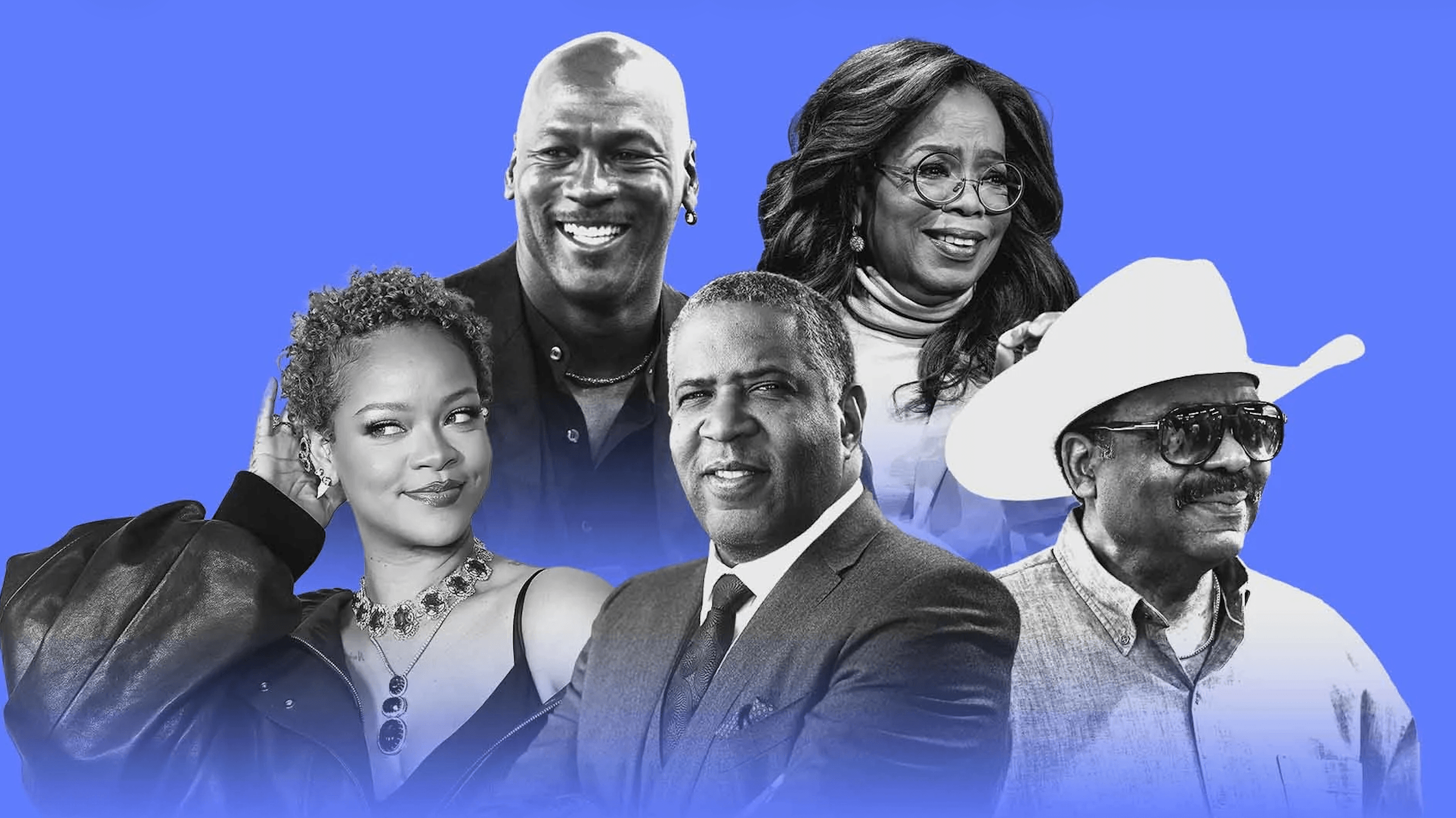

The $3 Trillion Wealth Shift: Black Ownership’s Defining Decade

By: Abdul-Karim Ngoliba

A historic $3 trillion wealth transfer is approaching, and it could redefine Black enterprise in America. If current trends hold, Black entrepreneurs are expected gain $87 billion of the transferring enterprise value. As Baby Boomers pass assets to younger generations over the coming decades, this shift represents more than inheritance. It is a structural opportunity. For Black communities navigating a persistent racial wealth gap, the transition of capital could mark a turning point in ownership, access, and long-term economic stability.