By Sharetta McLaughlin

- African American and Hispanic people are more likely to use buy now pay later (BNPL) plans during a recession and/or the holidays

- The global BNPL market is expected to grow 45% to $3.98T by 2030

With the rising cost of goods, people may feel that Buy Now Pay Later (BNPL) plans can help them buy products they need. Black (46%) and Hispanic/Latino (56%) communities have adopted using BNPL platforms at higher rates within the last year. Though most make their payments on time, the majority of people who use BNPL plans are in debt. Although these plans boast being able to help individuals raise their credit scores, many users do not access these plans for this feature.

Why This Matters: BNPL is a form of short term financing that allows individuals to make essential purchases. Since the pandemic, the usage of these plans have increased, with 56% of people claiming they’ll use BNPL plans again in the future. However, there can be heavy fees with BNPL plans and your account can be sold to credit collectors if you default.

By 2030, the BNPL market is expected to swell from $90.69 billion, to an astounding $3.98 trillion, representing a compound annual growth rate of 45%. Unlike traditional lending options, there are several risks, and not as many financial safeguards when it comes to BNPL plans. In the near future, the Consumer Financial Protection Bureau is set to issue regulations.

It is important to note that Black communities have faced discrimination related to fair lending which caused the passage of the Equal Credit Opportunity Act in the 1970s. This attempted to eliminate bias among lenders by preventing them from considering factors like an applicant’s age, race, sex, religion, etc.

Unfortunately, the existing system has been criticized for using factors that can be based on generational wealth disparities, such as income and homeownership. These factors tend to reflect in one’s credit score, particularly among the Black community. The average credit score in the Black community is 677, compared to White and Hispanics, which is 728 and 701 respectively.

Situational Awareness: The pandemic has positively impacted theBNPL plans. During the pandemic BNPL assisted people in making purchases without having to pay upfront. I know of several people who have multiple purchases through BNPL, for some it got to a point where their payments were a small check. The thought of 30 or 40 dollars every two weeks makes these plans enticing. As with anything we consume in life, these plans should be used in moderation.

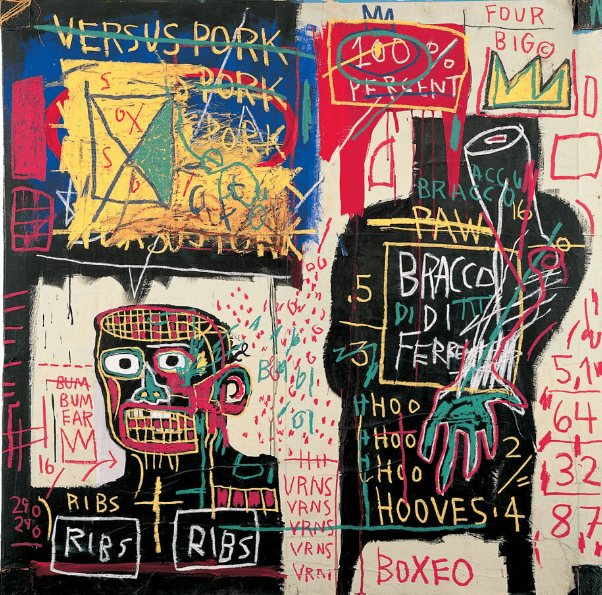

CBX Vibe: “Digits” Young Thug