By CultureBanx Team

- The U.S. Consumer Financial Protection Bureau’s plans to start regulating the “buy-now, pay-later” industry

- 12% of Blacks and 13% of Hispanic Americans saying they use BNPL for holiday purchases

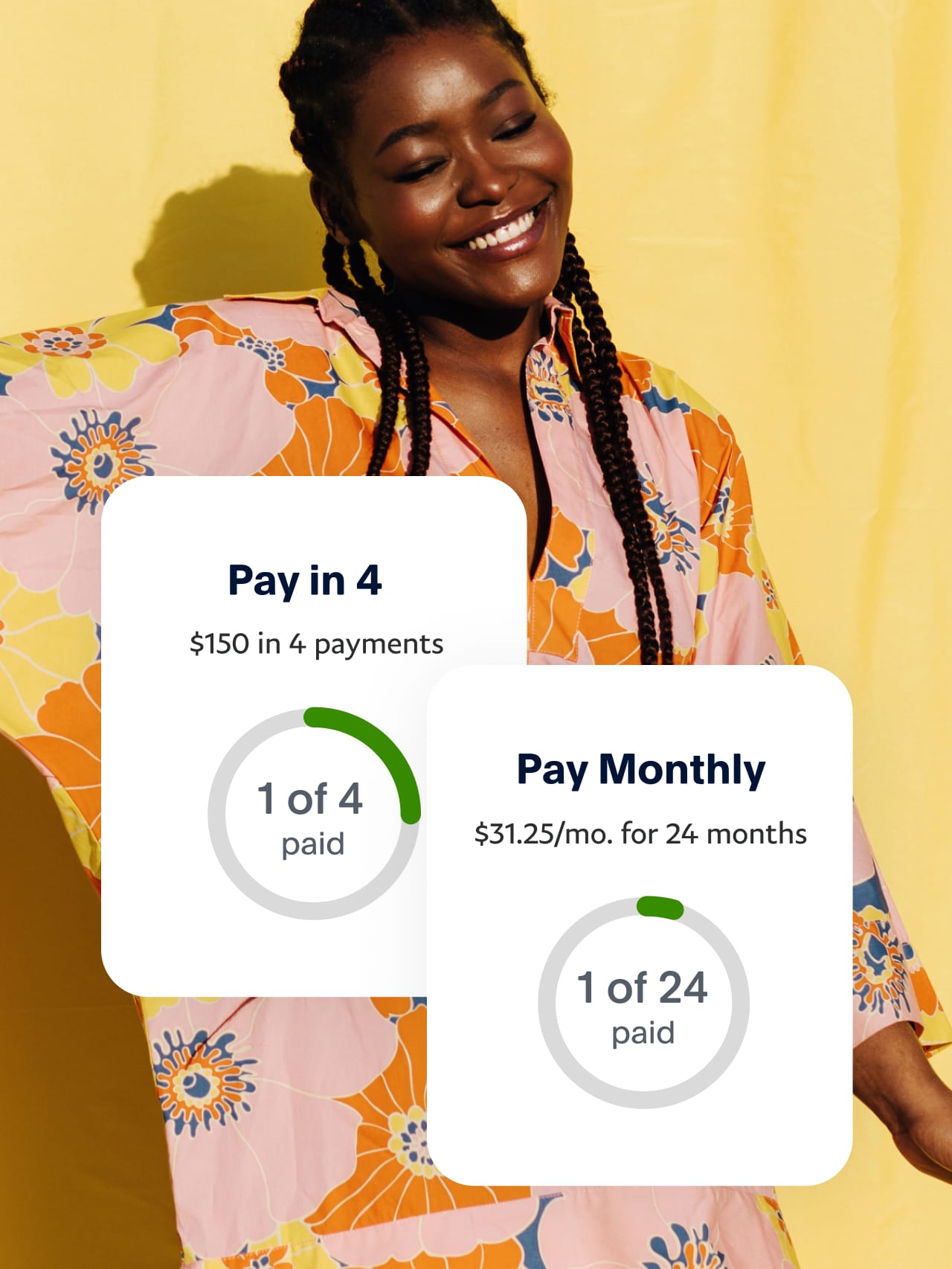

Fast growing “buy-now, pay-later” (BNPL) companies have caught the U.S. Consumer Financial Protection Bureau’s (CFPB) attention as it plans to start regulating the industry. BNPL companies like Klarna and Affirm(AFRM -15.57%) have caused regulators to worry that their financing products are harming consumers. With the BNPL market expected to reach $3.98 trillion by 2030, according to Allied Research, here-in lies the issue, many consumers don’t realize BNPL plans are a form of credit or a loan, and 27% of Black households are late on paying their debts.

Why This Matters: BNPL services, which allow consumers to split purchase payments into installments, exploded in popularity as Americans turned to online shopping during the coronavirus pandemic. CNBC’s Small Business Survey reported higher BNPL popularity among Black and Hispanic Americans with 12% of Blacks and 13% of Hispanic Americans saying they use BNPL for holiday purchases, compared to only 5% of white Americans. Last year alone, Americans spent $20.8 billion through these BNPL services, with purchases overall up 230% since the start of 2020, according to a study by Accenture.

The CFBP, which does not currently oversee BNPL companies or products, will issue guidance or a rule to align sector standards with those of credit card companies. After an inquiry in 2021, the CFPB found that BNPL providers Affirm Holdings, Block’s Afterpay, Klarna, PayPal and Australia’s Zip originated a combined 180 million loans in 2021, totaling $24.2 billion, a more than 200% annual increase from 2019, according to Reuters.

Situational Awareness: The sector is already under pressure due to rising funding costs and lower American consumer spending during soaring inflation. Share prices of public “buy-now, pay-later” companies have been under pressure this year, with Affirm and Zip down more than 70%. Klarna’s valuation fell more than 80% in July.

CBX Vibe: “Credit” Ty Dolla $ign