By CultureBanx Team

- Ex-Credit Suisse CEO Tidjane Thiam SPAC Freedom Acquisition I has parted ways with Pimco

- Thiam already raised $345 million through a 2021 IPO of Freedom Acquisition I on the NYSE

Blank-check SPAC Freedom Acquisition I Corp, helmed by former Credit Suisse CEO Tidjane Thiam has parted ways with Pimco, which offloaded its stake to Next G, an affiliate of Edward Zeng’s advisory firm China Bridge Capital. It’s very rare for a SPAC’s early backers to walk away from the investment after it starts trading, especially with the strong leadership that someone like Thiam, an Ivory Coast native, brings to the company.

Why This Matters: Freedom Acquisition I priced its $345 million IPO on February 25 last year and aims to combine with a scalable fintech target with distinct business strengths and differentiations, focusing on businesses that are technology-enabled and demonstrate growth and scalability potential. One of Pimco’s private funds was part of its sponsor group and committed to buying shares in the IPO.

Thiam stated that for his special purpose acquisition company Chinese entrepreneur Edward Zeng is a “better fit” than US investment giant Pimco, the Financial Times reported.

High-profile investors were flocking to support SPACs from financiers in Europe. Thiam’s blank-check IPO attracted investors including Francois Pinault, the billionaire founder of luxury conglomerate Kering SA. With Pimco now out perhaps that sentiment is changing.

Thiam has a plethora of experience leading companies through rough patches. After successfully leading the turnaround of the insurer Prudential (PRU -2.55%) from 2009 to 2014, he took the helm of Credit Suisse in July 2015 and successfully restructured the bank in a financial year in which the firm posted a $3 billion loss. Thiam has a solid proven track record of making companies successful, and would be able to do the same thing with Freedom Acquisition I.

For Thiam his tenure oversaw a shift in Credit Suisse’s focus from investment banking to wealth management and, amidst a troubling period for many European banks, before a return to profitability in 2018. As a Black CEO of a major investment bank, a rarity in the finance world, Thiam was beleaguered by a scandal in which the bank conducted spying operations against two departing senior employees.

What’s Next: This is now the third SPAC in roughly a week’s time that has negotiated a new arrangement for its sponsor. This comes on the heels of Group Nine’s deal with the 890 5th team, and Tribe Capital Markets resigning from Tribe Capital Growth Corp. I’s sponsor group. At this point, Freedom I Acquisition still has nearly nine months left to find an acquisition with a deadline date of March 2, 2023.

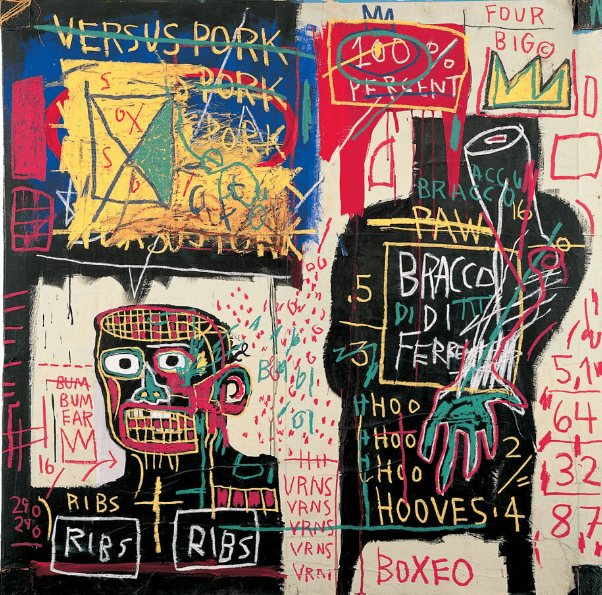

CBx Vibe: “Switch It Up” Pooh Shiesty