By Ariel Solomon

- Giannis Antetokounmpo has lent his namesake to the Calamos Antetokounmpo Sustainable Equities Trust that will invest at least 80% in assets that meet ESG criteria

- ESG assets may hit $53T by 2025, a third of global AUM

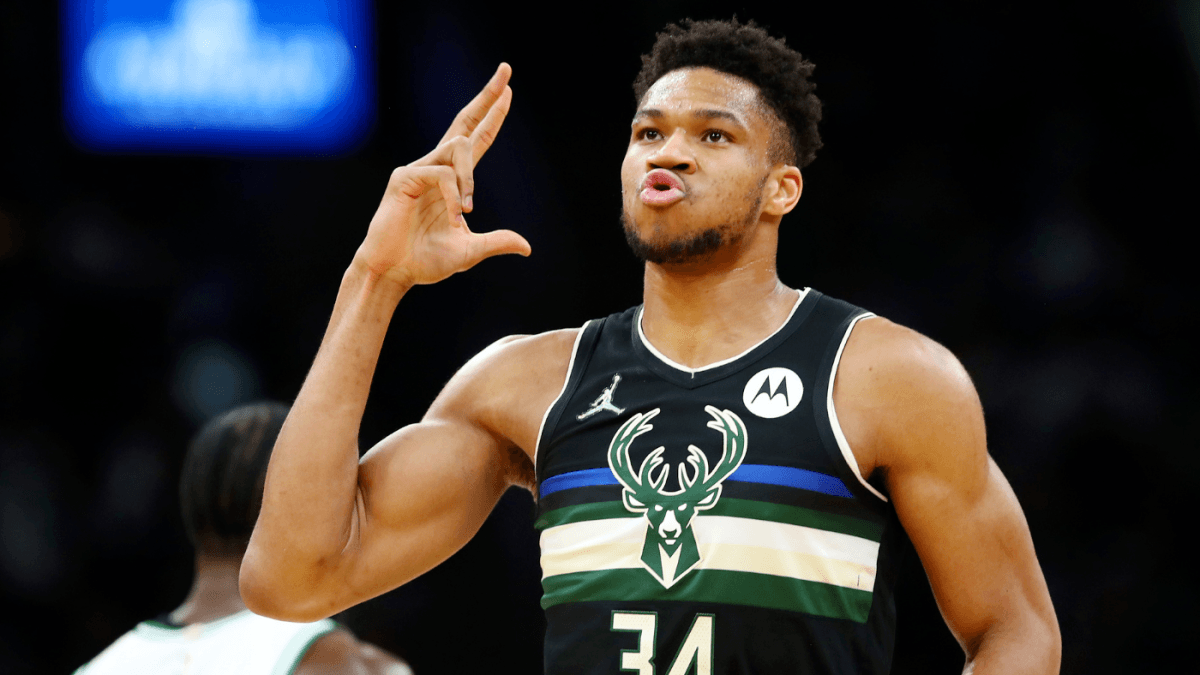

NBA phenom Giannis Antetokounmpo is starting his own sustainability playbook off the court. He is teaming up with Illinois-based Calamos Advisors to create the Calamos Antetokounmpo Sustainable Equities Trust, according to a recent SEC filing. The fund will focus on companies that prioritize environmental strategies, human rights, equality, and societal impact, as these assets are on pace to hit $53 trillion by 2025, or a third of all assets under management (AUM).

Why This Matters: While the value of Antetokounmpo’s investment and principal role within the fund remain unclear, the athlete’s agreement to lend his name to this venture sends a positive signal for the future of Environmental, Social, and Governance or “ESG” funds. The Calamos Antetokounmpo Sustainable Equities Trust will require at least 80% of its assets to be invested in sustainable equities that are in line with its philosophy. As the team looks to steer clear of investments tied to negative outcomes, and activities deemed environmentally risky or which present unattractive social outcomes from its portfolio, and focus on those that do good instead.

This may come as no surprise since there’s been a meaningful growth in ESG investing over the past decade. Investors are seeking to prioritize funding companies that drive positive social outcomes, and are seeing a competitive financial return in the process. Specifically, the Calamos Antetokounmpo Sustainable Equities Trust will steer clear of companies operating in the “Agricultural Biotechnology, Alcohol, Animal Testing, Fossil Fuels, Gambling, Metals & Mining, Nuclear Energy, Tobacco and Weapons” per the SEC filing. According to recent data comparing the S&P 500 to the S&P 500 ESG index, the ESG index performed slightly better, by four points on average. So it reasons that an investor would ponder – why not do good, if I can make money in the process.

Situational Awareness: ESG investing has created a meaningful path for investors to both build wealth and put their money where their mouths are. As ESG assets take up an increasingly larger share of the pie, this will force companies to think twice about the impacts and externalities that result from their business practices. This shift will put new markets at the forefront, drive ostensibly positive corporate behaviors, and continue to shape resulting portfolios and ranges of returns for the foreseeable future.

CBX Vibe: “Get a Lil Bag” Tobe Ngigwe