By CultureBanx Team

- Robert F. Smith’s Vista Equity Partners has successfully surpassed a significant milestone of $100B in assets under management

- Vista has completed or signed 18 monetization events since November 2021 including the $4.6B sale of Apptio to IBM

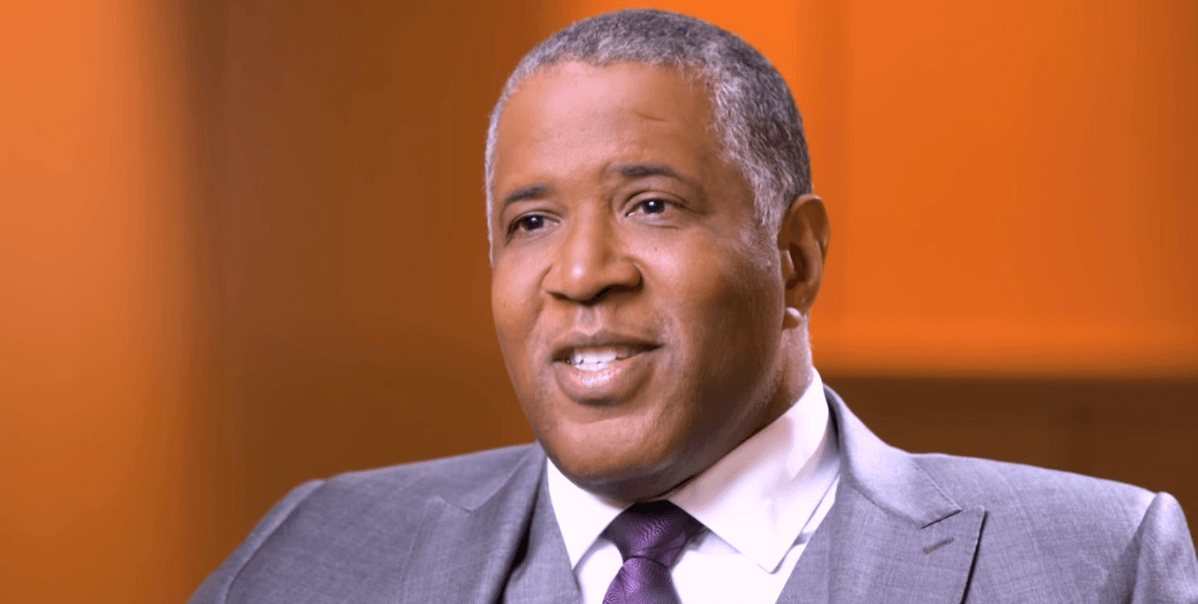

Technology’s landscape of mergers and acquisitions (M&A) is currently experiencing a significant shift, with private equity firms emerging as dominant players. Among these, one name stands out which is Robert F. Smith’s Vista Equity Partners. With a robust portfolio and an innovative approach, Vista has successfully surpassed a significant milestone of $100 billion in assets under management (AUM).

Why This Matters: Vista’s investment approach is centered around investing in businesses that leverage technology to promote economic equity, ecological responsibility, and diversity and inclusion. The firm has completed or signed 18 monetization events since November 2021, including the $4.6 billion sale of Apptio to IBM (IBM %+0.59). Apptio’s sale doubled Vista revenue bringing a return of 142% on the initial $1.9 billion investment.

These deals compliment Smith’s strong track record of identifying promising tech companies and helping them achieve their full potential. Back in December 2021, Vista Equity Partners had around $93 billion in AUM assets, according to the company.

“Since Vista was founded over two decades ago, we’ve expanded to 650+ team members operating around the world, built a comprehensive library of enterprise software best practices and much more,” Smith wrote on LinkedIn.

Gone are the days when private equity firms were considered only as cost-cutting entities. Today, they are seen as value creators. They have grown into subject matter experts, offering technology companies operational expertise and opportunities to invest in sales, marketing, and research and development. This has been instrumental in the rise of private equity in technology M&A, with firms like Vista Equity Partners at the forefront.

Situational Awareness: With the increasing specialization of private equity firms and the challenging environment for tech IPOs, the role of private equity in tech M&A is likely to grow further. Through its focused investment strategy, operational expertise, and ability to deliver impressive returns, Vista will be the one leading the new reshaped technology investment landscape.

CBX Vibe: “Billionaire” Travie McCoy & Bruno Mars